A Revocable Living Trust will not protect your assets if you go into a nursing home. This is because in a Living Trust, the assets are still under the owner’s control. To shield your assets from spend-down before you qualify for Medicaid, you will need to create an Irrevocable Living Trust.

The primary difference between a Revocable and Irrevocable Living Trust are as follows: In a Revocable Trust, the terms of the Trust, beneficiary of the Trust, and the assets of the Trust are owned by the Trust creator and therefore can be changed at their discretion. In an Irrevocable Trust, the terms of the Trust, beneficiary of the Trust, and the assets of the Trust are NOT owned by the Trust creator, and therefore cannot be changed at their discretion.

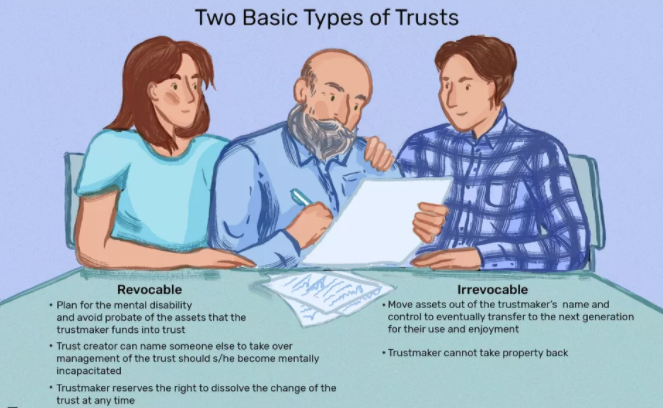

The primary differences and benefits of the Revocable and Irrevocable Trust are summarized in the image below.